Maximize Your Tax Deductions With a Simple and Efficient Gas Mileage Tracker

In the world of tax deductions, tracking your mileage can be an often-overlooked yet crucial task for maximizing your financial benefits. Comprehending the nuances of reliable mileage monitoring might expose approaches that might significantly influence your tax scenario.

Relevance of Gas Mileage Tracking

Tracking mileage is crucial for anybody looking for to optimize their tax obligation reductions. Accurate mileage tracking not only ensures compliance with IRS guidelines but also permits taxpayers to take advantage of reductions connected to business-related traveling. For freelance individuals and business proprietors, these deductions can considerably minimize taxable revenue, therefore lowering general tax obligation responsibility.

Moreover, keeping a thorough record of gas mileage aids identify between individual and business-related trips, which is crucial for confirming cases during tax obligation audits. The IRS calls for details documents, consisting of the date, location, function, and miles driven for each trip. Without meticulous documents, taxpayers take the chance of shedding important deductions or dealing with penalties.

Additionally, effective gas mileage tracking can highlight fads in traveling expenses, aiding in far better financial planning. By analyzing these patterns, people and businesses can determine possibilities to maximize traveling courses, reduce expenses, and boost functional effectiveness.

Choosing the Right Mileage Tracker

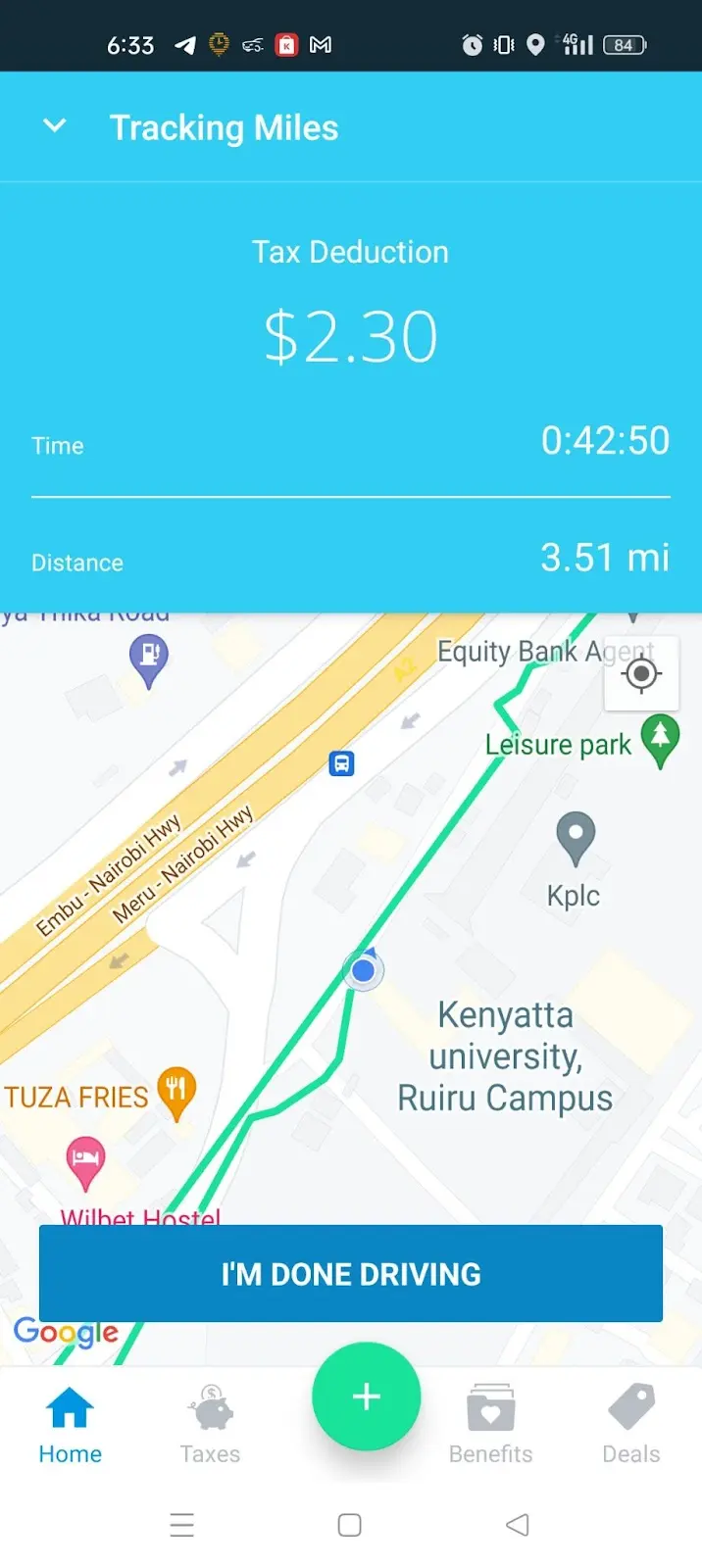

When selecting a gas mileage tracker, it is necessary to consider numerous features and functionalities that line up with your details requirements (best mileage tracker app). The initial element to examine is the approach of monitoring-- whether you choose a mobile application, a GPS gadget, or a hand-operated log. Mobile apps usually offer benefit and real-time tracking, while GPS tools can offer even more precision in distance measurements

Following, examine the assimilation capacities of the tracker. A great mileage tracker must perfectly integrate with audit software application or tax preparation devices, permitting for straightforward information transfer and coverage. Seek attributes such as automated tracking, which reduces the need for manual entrances, and categorization options to compare business and individual trips.

How to Track Your Gas Mileage

Choosing an appropriate mileage tracker sets the structure for effective mileage management. To properly track your gas mileage, begin by establishing the function of your travels, whether they are for business, philanthropic tasks, or clinical reasons. This quality will assist you categorize your journeys and guarantee you record all pertinent information.

Next, continually log your gas mileage. If using a mobile application, enable place Find Out More solutions to immediately track your trips. For hand-operated entrances, document the beginning and finishing odometer analyses, in addition to the date, objective, and route of each trip. This degree of information will verify important during tax period.

It's also vital to consistently evaluate your access for precision and efficiency. Set a schedule, such as weekly or regular monthly, to consolidate your documents. This method assists avoid disparities and guarantees you do not forget any type of deductible gas mileage.

Lastly, back up your documents. Whether digital or paper-based, keeping backups protects versus data loss and promotes simple gain access to during tax obligation preparation. By carefully tracking your mileage and keeping organized documents, you will lay the groundwork for maximizing your possible tax reductions.

Taking Full Advantage Of Deductions With Accurate Records

Accurate record-keeping is vital for optimizing your tax reductions related to gas mileage. When you maintain in-depth and accurate documents of your business-related driving, you create a robust foundation for claiming reductions that might dramatically Web Site lower your taxable income.

Utilizing a mileage tracker can simplify this process, enabling you to log your journeys easily. Numerous apps immediately calculate distances and categorize trips, conserving you time and reducing mistakes. Additionally, keeping sustaining paperwork, such as invoices for associated expenditures, reinforces your instance for deductions.

It's crucial to correspond in recording your gas mileage. Daily monitoring makes sure that no journeys are ignored, which could lead to missed reductions. Consistently evaluating your logs can aid identify patterns in your driving, permitting far better preparation and potential tax cost savings. Inevitably, accurate and orderly gas mileage documents are key to maximizing your deductions, guaranteeing you make the most of the potential tax benefits offered to you as a company motorist.

Typical Blunders to Avoid

Keeping precise documents is a significant action toward maximizing mileage reductions, yet it's just as crucial to be familiar with usual mistakes that can threaten these initiatives. One common error is stopping working to document all journeys precisely. Even small business-related trips can accumulate, so overlooking to videotape have a peek at these guys them can cause substantial lost deductions.

An additional blunder is not setting apart between personal and company mileage. Clear classification is critical; mixing these two can set off audits and cause fines. Furthermore, some individuals forget to maintain supporting documents, such as receipts for related expenses, which can better confirm cases.

Making use of a mileage tracker app guarantees regular and reliable records. Familiarize yourself with the most current regulations relating to mileage deductions to prevent unintentional mistakes.

Conclusion

To conclude, efficient mileage tracking is necessary for making best use of tax deductions. Using a trusted mileage tracker streamlines the process of tape-recording business-related trips, guaranteeing accurate documents. Regular evaluations and backups of gas mileage records enhance compliance with internal revenue service regulations while sustaining educated economic decision-making. By staying clear of typical challenges and maintaining precise documents, taxpayers can substantially reduce their overall tax obligation obligation, inevitably benefiting their financial health and wellness. Implementing these practices cultivates a proactive strategy to managing company expenditures.